ASTRAZENECA (AZN)·Q4 2025 Earnings Summary

AstraZeneca Q4 2025 Earnings: Beat, Pipeline Momentum Accelerates Toward $80B Target

February 10, 2026 · by Fintool AI Agent

AstraZeneca delivered another strong quarter, beating revenue expectations by 2.9% as its oncology franchise continues to power growth. Full-year 2025 revenue grew 8% (product revenue +10%) with core EPS up 11% — the company's ninth consecutive beat. Management reiterated confidence in the $80 billion 2030 revenue ambition, now supported by 16 blockbuster medicines and 100+ Phase 3 trials ongoing.

The stock fell 2.6% following the release, likely reflecting investor concerns about near-term headwinds from the US Farxiga loss of exclusivity in April 2026 and China VBP implementation for key products.

Did AstraZeneca Beat Earnings?

Yes — revenue beat by 2.9%, full-year EPS +11%.

*Values retrieved from S&P Global.

The revenue beat was driven by continued strength across oncology (+17% YoY excluding the 2024 Lynparza milestone), with Q4 oncology revenue exceeding $7 billion for the first time.

Key highlights:

- Tagrisso: Surpassed $7B in full-year revenues (+10% growth)

- Imfinzi: Exceeded $6B (+37% Q4 growth)

- Enhertu: $2.5B+ in AZ share (+46% Q4 growth)

- Calquence: Exceeded $3.5B (+17% Q4 growth)

What Did Management Guide?

AstraZeneca issued 2026 guidance that reflects confidence in underlying momentum despite significant near-term headwinds:

Key 2026 Headwinds Factored In:

- Farxiga US LOE (April 2026): US represented $1.7B or 21% of global Farxiga revenue in 2025

- China VBP: Implementation in Q1 2026 for Farxiga, Lynparza, and Roxadustat

- MFN Deal: Effect already factored into guidance

CEO Pascal Soriot expressed increasing confidence in the $80B 2030 target: "Our confidence in delivering the $80 billion ambition by 2030 is definitely increasing. With our broad portfolio and deep pipeline, the meaningful progress we're making with our multiple transformation technologies, we can definitely reach this $80 billion ambition and continue to grow past 2030."

What Changed From Last Quarter?

Pipeline Momentum Accelerating:

- Now have 100+ Phase 3 trials ongoing (vs. 90+ last quarter)

- 16 blockbuster medicines in 2025 (up from 12 in May 2024), targeting 25 by 2030

- 16 positive Phase 3 readouts in 2025 with combined peak-year sales potential of $10B

- 43 approvals secured across major regions in last 12 months

New Pipeline Developments:

- Elecoglipron (oral GLP-1): Phase 2b met primary endpoints in both VISTA and SULSTAS trials; entering Phase 3 this year

- Weight Management Portfolio: Building differentiated approach with oral GLP-1, amylin agonist, and dual GLP-1/glucagon combinations

Regional Dynamics:

- Emerging Markets (ex-China): +22% growth — becoming increasingly important

- China: Still grew 4% despite Pulmicort generics; remains largest pharma company in China

- Europe: +7% growth with patent protections for Farxiga extending to 2028

Business Segment Performance

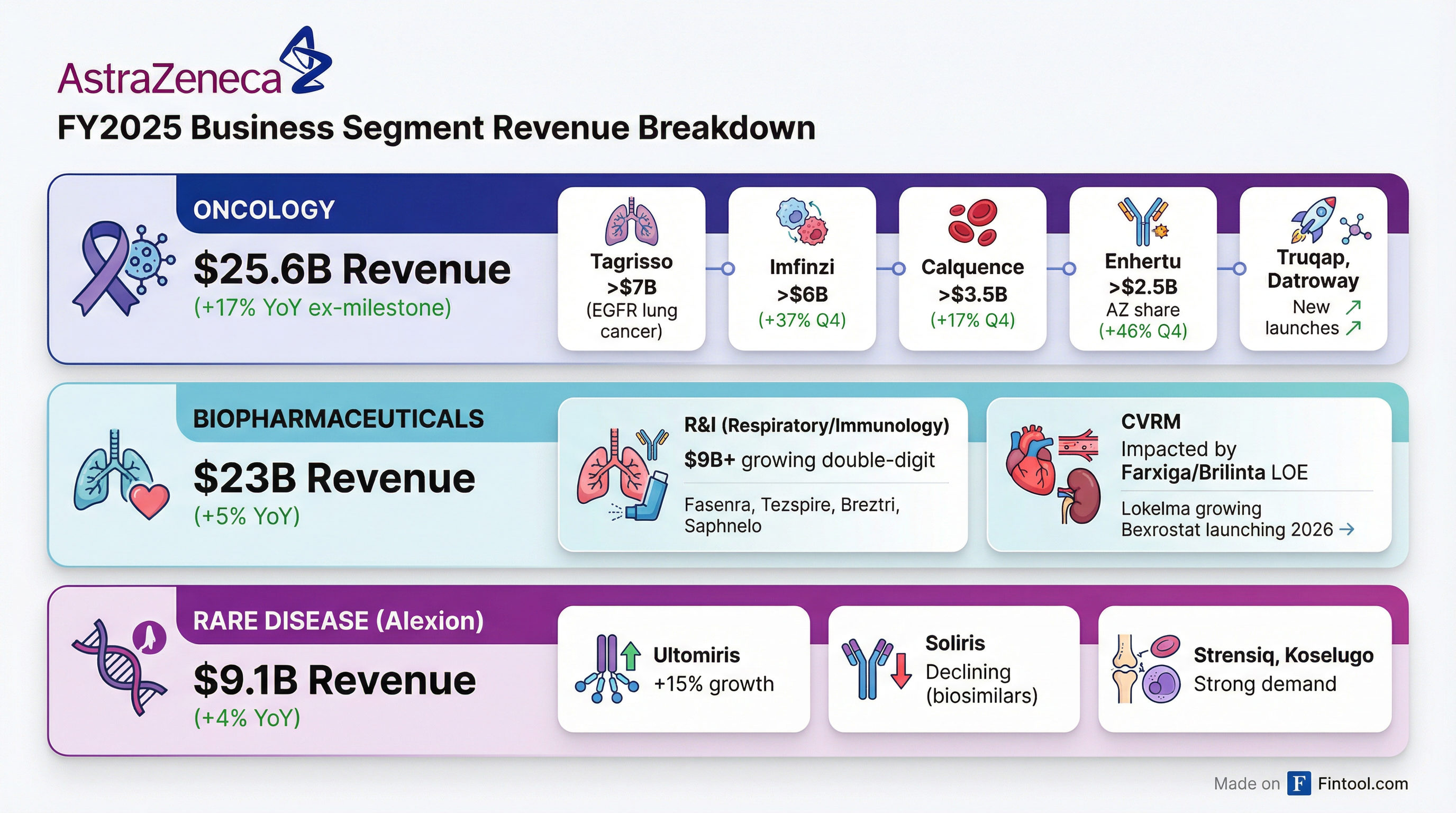

Oncology: $25.6B (+17% ex-milestone)

The oncology franchise continues to be the primary growth engine, with Q4 revenues exceeding $7 billion for the first time:

BioPharmaceuticals: $23B (+5%)

R&I (Respiratory & Immunology) delivered +10% Q4 growth, while CVRM faced headwinds from Brilinta and Farxiga patent expiries:

Rare Disease (Alexion): $9.1B (+4%)

Alexion has delivered low-double-digit CAGR from 2020-2025 at CER, with medicines now available in 75+ countries (up from 20 at acquisition).

How Did the Stock React?

AstraZeneca shares fell 2.6% following the Q4 results, closing at $188.01 (down from $193.03). After-hours trading showed a partial recovery to $190.50.

Why the decline despite the beat?

- Farxiga LOE concerns: US generics starting April 2026 ($1.7B or 21% of Farxiga revenue at risk)

- China VBP headwinds: Farxiga, Lynparza, Roxadustat entering VBP in Q1 2026

- Elevated R&D spending: Guidance for R&D at upper end of low-20s% of revenue

*Values retrieved from S&P Global.

Key 2026 Catalysts and Phase 3 Readouts

AstraZeneca expects 20 Phase 3 readouts in 2026, collectively representing $10B+ in risk-adjusted peak revenue potential.

High-Impact Readouts:

Near-Term Commercial Launches:

- Bexrostat (uncontrolled hypertension): US approval expected to coincide with Farxiga LOE; peak revenue potential >$5B

- AMPLIFY regimen (Calquence): US launch of finite therapy in CLL

- Enhertu expansions: First-line metastatic (DESTINY-Breast09), early breast cancer (DESTINY-Breast11, DESTINY-Breast05)

Q&A Highlights

On Weight Management Entry (responding to concerns about competitive market):

"We truly believe that the market is still quite immature. Combination therapies for obesity, overweight people, I think is very crucial in order to help those patients reduce their risk of cardiovascular events... We're doing a lot of R&D work regarding the quality of weight loss — not just percentage of weight loss, but are you able to preserve lean muscle? Are you able to attack the visceral fat?" — Ruud Dobber

On Elecoglipron Phase 3 Decision:

"We would never move a product into Phase 3 and unleash the kind of spend we are committing to if we didn't think we have a product with a competitive profile. The short answer is we believe we have a very competitive profile, and it doesn't rely on combinations. It relies on the monotherapy itself." — Pascal Soriot

On China Positioning:

"We feel very confident that we will continue to see the growth of the new launches, specifically driven by our success of including Fasenra, Kappa, and Calquence tablets in the NRDL starting January 1st this year." — Iskra Reic

On Capital Allocation:

"The $80 billion ambition was on an organic basis, and that does not assume any M&A of any size and scale. We do have substantial firepower — we're very comfortable at 1.2x leverage, but we have plenty of capacity. That said, we remain very disciplined in terms of what type of assets we bring in." — Aradhana Sarin

Capital Allocation and Balance Sheet

2026 Investments Include:

- US and China manufacturing expansion

- ADC facility in Singapore

- 2026 milestone payments expected: ~$2.5B

The Bottom Line

AstraZeneca delivered a solid beat in Q4, extending its streak of positive earnings surprises. The real story is the pipeline momentum — 100+ Phase 3 trials, 16 blockbusters, and 20 readouts expected in 2026 that could add $10B in peak revenue potential.

Bulls will point to:

- Oncology strength (+17% growth, four $3B+ products)

- Pipeline depth (100+ Phase 3 trials)

- Weight management entry with competitive oral GLP-1

- Bexrostat launch potential (>$5B peak)

- $80B 2030 target increasingly achievable

Bears will focus on:

- Farxiga US LOE ($1.7B at risk) starting April 2026

- China VBP implementation for key products

- Elevated R&D spending (upper end of low-20s%)

- Stock trades near 52-week highs despite near-term headwinds

At $188 with a $210 analyst target, AstraZeneca offers 12% upside to consensus. The Phase 3 readouts in 2026 — particularly AVANZAR (lung cancer), CARDIO-TTRansform (ATTR cardiomyopathy), and the tosiracumab COPD program — represent meaningful catalysts that could drive estimates higher if successful.